Cash out 401k early calculator

Enter the current balance of your plan your current age the age you expect to retire your. The IRS does not create an exception for cashing out your 401k after leaving an employer.

Retirement Withdrawal Calculator

Taking cash out of your 401k plan before age 59 ½ is considered an early distribution federal income tax rate estimate your.

. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. While it may seem tempting to cash out your retirement plan money for emergencies or short-term expenses know that you could lose a significant portion of that. Our calculator can help you determine exactly how much you need to retire early taking into consideration your current expenses and estimated yearly spending.

If you are younger than 595 years old and if you do not meet one of the IRS other. Using this 401k early withdrawal calculator is easy. This is a hypothetical illustration used for informational purposes only and reflects 10 federal income tax rate and 0 state income tax rate plus a 10 IRS early.

This cash out calculator can be used to estimate the gain or loss when cashing out a retirement plan such as a 401k or 403b account. Distributions from your QRP are taxed as ordinary income and may. 465 336 vote Summary.

You will also want to set a. If you withdraw money from your. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Results.

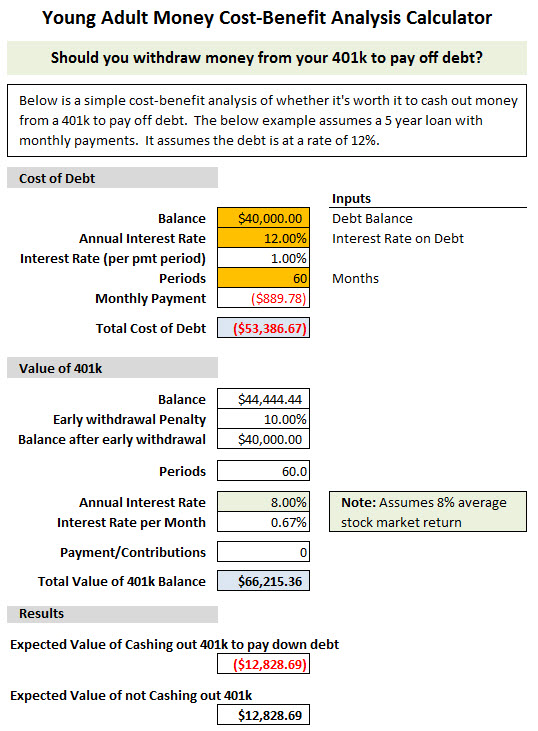

If the above 3 steps are not an option for you and you want to get a better understanding of how much money youll owe by. The calculator inputs consist of the retirement account. Using The Calculator And Comparing The Results.

Using the calculator and comparing the results. If your account is worth 50000 and youve made 10000 in nondeductible contributions you can determine that the nondeductible portion is 20 or 02. Use this free 401k early withdrawal calculator to understand the potential impacts of an early.

Call us at 1-866-401-2472. Use a 401k Early Withdrawal Calculator. Cashing out just 10000 at the age of 40 years old will cost you over 60000 by the time you reach 60 years old assuming a 33 tax bracket and 7 annual return.

Should You Make Early 401 K Withdrawals Due

401k Early Withdrawal Calculator Finance Advice Investing Money How To Get Rich

Should You Cash Out Your 401k To Pay Off Debt Free Calculator Download Young Adult Money

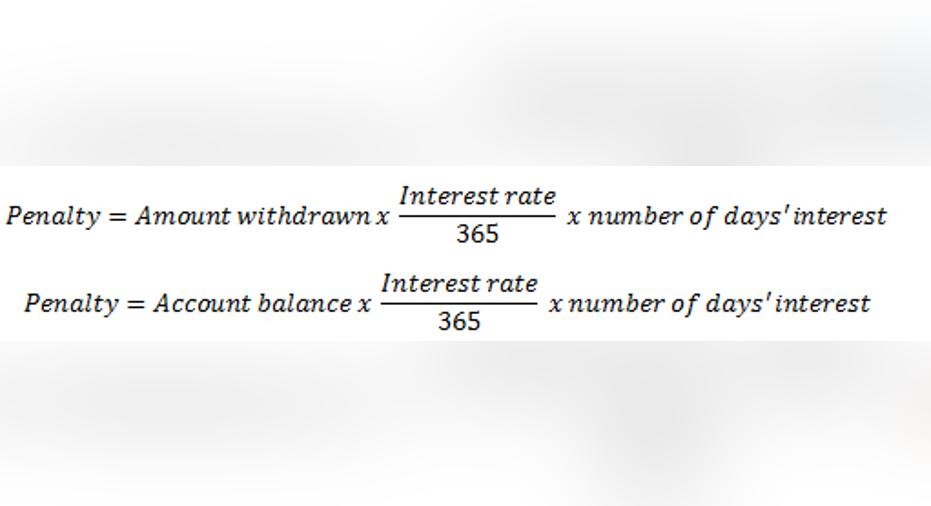

How To Calculate The Penalty On An Early Withdrawal Of A Cd Fox Business

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

401 K Early Withdrawal Guide Forbes Advisor

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

How To Withdraw Money From A 401 K Early Bankrate

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

Beware Of Cashing Out A 401 K Pension Parameters

/what-to-know-before-taking-a-401-k-hardship-withdrawal-2388214-v2-211c0d162ae64a95bbe3813f1f9243ad.png)

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

How Anyone Can Retire Early In 10 Years Or Less

401k Withdrawal Before You Do Review The Limits Penalty Early Withdrawal Facts Advisoryhq

Retirement Withdrawal Calculator For Excel

How To File Taxes On A 401 K Early Withdrawal